Our GST Services

Comprehensive solutions to manage all aspects of your GST compliance efficiently.

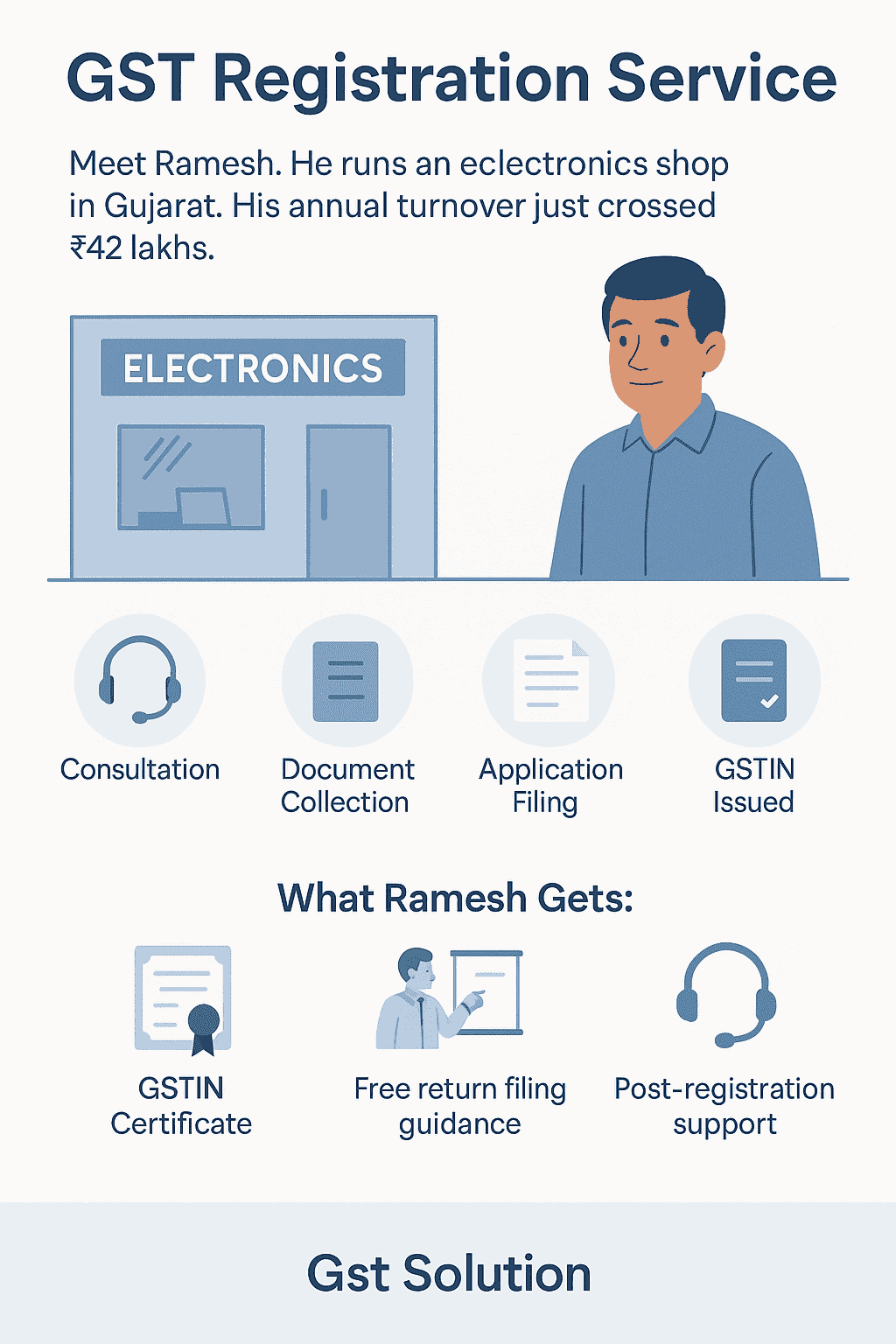

GST Registration

Getting your business registered under GST is the first step towards compliance. We simplify this process, handling all documentation and application procedures efficiently.

- Eligibility assessment and consultation.

- Documentation preparation and verification.

- Online application filing (ARN generation).

- Assistance in obtaining GSTIN certificate.

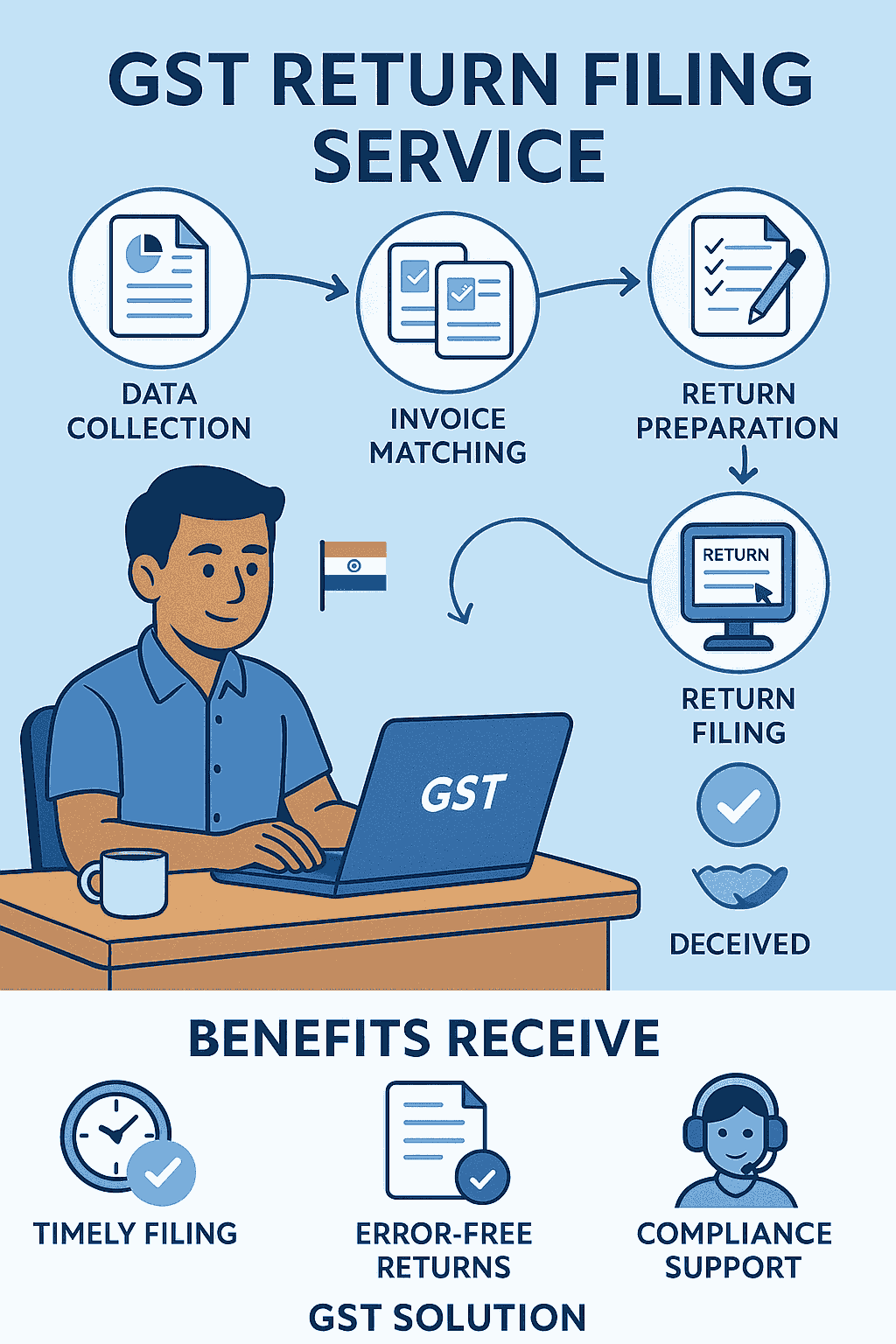

GST Return Filing

Ensure accurate and timely submission of your GST returns to avoid penalties and maintain a healthy compliance rating.

- Monthly/Quarterly Filing (GSTR-1, GSTR-3B).

- Annual Return Filing (GSTR-9/9C).

- Composition Scheme Returns.

- Input Tax Credit (ITC) reconciliation.

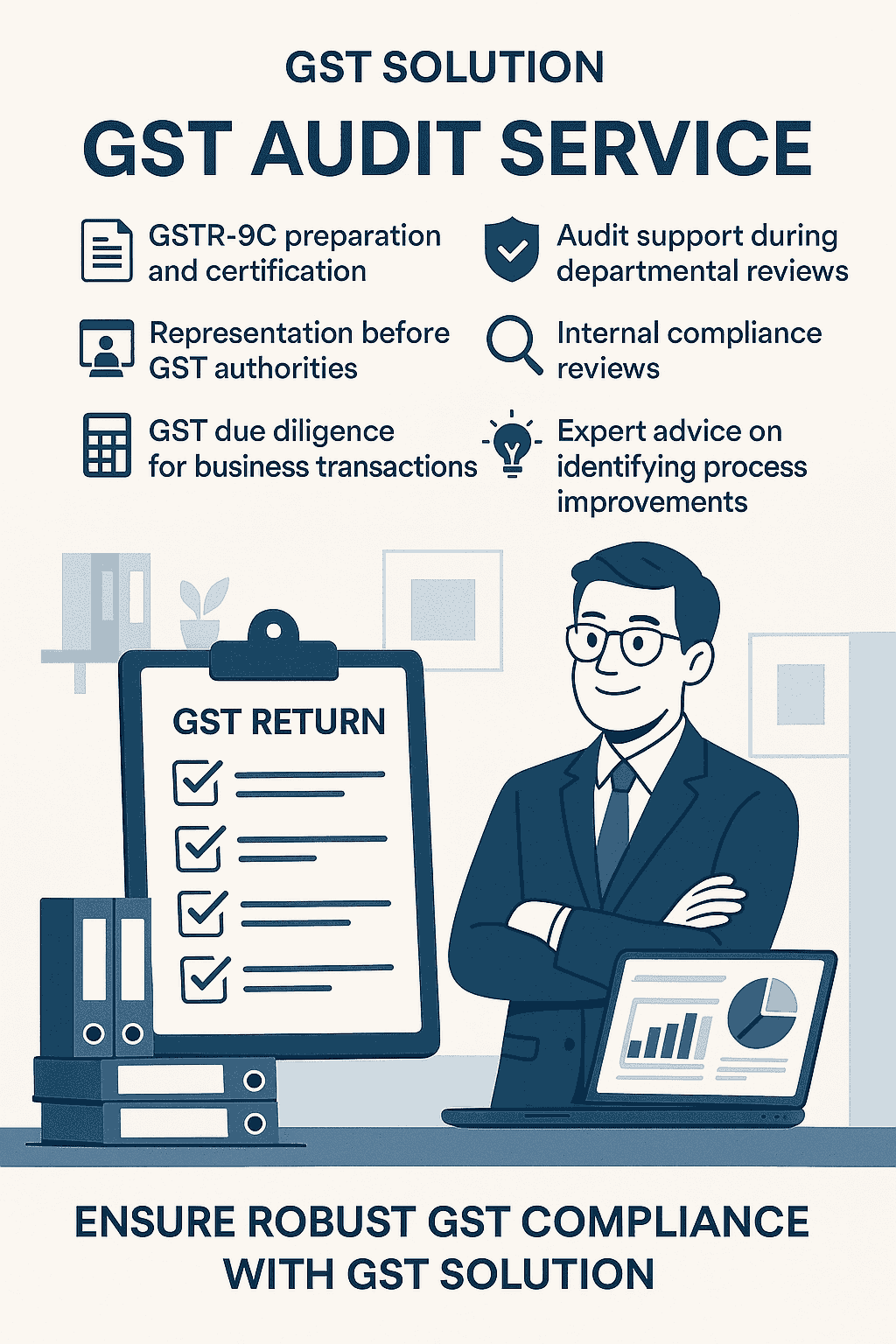

GST Audit & Assurance

Prepare for and effectively manage departmental audits or conduct internal reviews to ensure robust compliance.

- Support during departmental audits.

- Representation before authorities.

- Internal GST compliance reviews.

- Identifying process improvements.

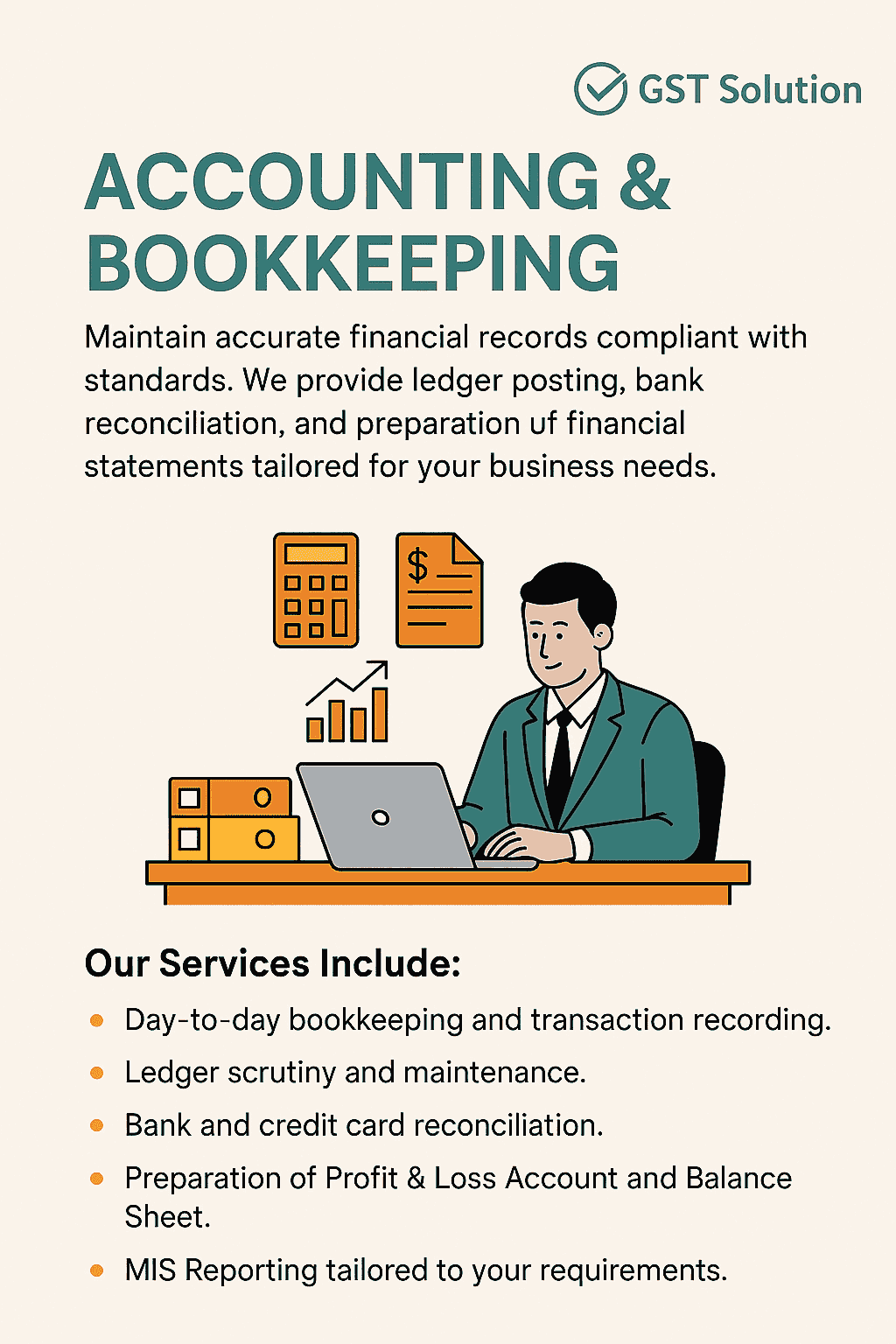

Accounting & Bookkeeping

Maintain accurate financial records compliant with standards. We provide bank reconciliation and statements preparation.

- Day-to-day transaction recording.

- Bank and credit card reconciliation.

- Profit & Loss and Balance Sheet.

- Custom MIS Reporting.

Income Tax Filing

Comprehensive ITR filing for individuals and corporate entities with optimization strategies.

- ITR filing for Salaried Individuals.

- ITR filing for Businesses & Professionals.

- Corporate Tax Return Filing.

- Tax optimization planning.

Not Sure Which Service You Need?

Contact us for a free, no-obligation consultation. We'll help you understand your GST requirements and recommend the most suitable solutions for your business.